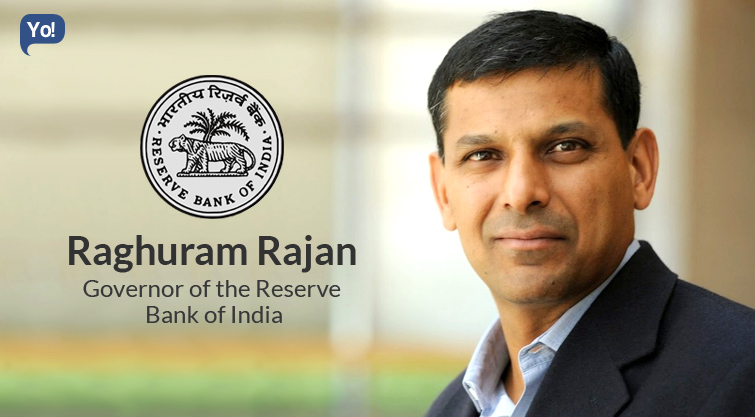

Raghuram RajanGovernor of the Reserve Bank of India Published On: Friday, June 24, 2016 Views 19287

Who is Raghuram Rajan?

Born on the 3rd of February 1963, Raghuram Govind Rajan is the 23rd Governor of the Reserve Bank of India.

This is equivalent to the Chairman of the US Federal Reserve, but his office, in reality, can also be considered as the true Deputy Finance Minister of the Country.

Famously known as the “Financial Prophet” and a “Rockstar” by many, he has not only managed to attain a fan following in India but has grown into becoming a Global Icon.

Raghuram is rated as one of the most influential economists of his generation and is the second youngest governor of the RBI after Manmohan Singh.

He is the same person who had warned about the growing risks in the financial system along with proposed policies that would reduce such risks in 2005, at the Federal Reserve annual Jackson Hole conference.

His warnings were termed as “misguided” and Rajan himself was called a “luddite”, by the former U.S. Treasury Secretary Lawrence Summers.

However, his warnings came to reality during the Economic crisis of 2008! Since then no one in the world dares to take him lightly. He was even extensively interviewed for the Oscar-winning documentary Inside Job (2010).

He had also written a book called –– “Fault Lines: How Hidden Fractures Still Threaten the World Economy”, that had won the Financial Times-Goldman Sachs Business Book of the Year award in 2010, and had co-authored a book called –– “Saving Capitalism from the Capitalists” with Luigi Zingales in 2003, too!

Honestly speaking – the RBI has seen many governors with both, the highest intellect and integrity, but none of these have even remotely come close to the popularity that Raghuram has achieved.

He is someone who does not drop a sweat of fear to speak his mind with a courage of conviction and air of confidence. Be it questioning the government, or telling a room full of journalists that “RBI is not a cheerleader”, Raghuram is someone who believes in calling a spade a spade!

As the governor of the RBI, Raghuram draws a petty monthly salary (keeping in mind his achievements) of ₹1.98 lakhs (as of June 2015), but the perks drawn by him are same as that of the Cabinet Secretary to the Government of India.

Some these include having your signature across all currency notes in the country, and a colonial bungalow on Carmicheal Road, alongside India’s richest industrialists.

Talking about his personal life – Raghuram is married to Radhika Puri Rajan, a fellow student at IIM Ahmedabad. They have a daughter and a son.

Some of his favourite past times include reading, solving quizzes, running, playing tennis and squash, etc….

And lastly, about his achievements – amongst his many, many accolades, some of his most treasured accomplishments include: -

- Named as the ‘100 Most Influential People in the World’ by Time Magazine (2016)

- Awarded by the Center for Financial Studies-Deutsche Bank Prize for financial economics (2013)

- Listed as a member of the Group of Thirty (2012)

- Awarded with the Infosys prize for the Economic Sciences (2012)

- Awarded as the Global Indian of the year by NASSCOM (2011)

- Named as the President of the American Finance Association and member of the American Academy of Arts and Sciences (2011)

- Awarded with the inaugural Fischer Black Prize for the best finance researcher under the age of 40 by the American Finance Association (2003)

Journey to becoming the governor of RBI…!

Raghuram Rajan was born in Bhopal in Madhya Pradesh, to an Indian Police Service officer who topped his 1953 batch.

He was the third of four children of R Govindarajan. He has two brothers and one sister. Raghuram’s elder brother works for a solar company in the US, his sister is married to an Indian Administrative Service (IAS) officer and is a French teacher in New Delhi, and his younger brother is the Brand Custodian and Chief Ethics Officer of Tata Sons.

Later, R Govindarajan was assigned to the Intelligence Bureau and then the newly created external intelligence unit of the Intelligence Bureau – Research and Analysis Wing (R&AW).

Since the family travelled on diplomatic passports, throughout his childhood Raghuram’s thought that his father was a diplomat. It was only after he grew old, that he came to know that he was a spy.

Anyway, in 1974 the family returned to India, and Raghuram joined the Delhi Public School and then moved on to complete his Bachelors in Electrical Engineering from the IIT (Delhi), and lastly, attended the IIM (Ahmedabad) for his Post Graduate Diploma in Business Administration.

Post that, he then joined Tata Administrative Services as a Management Trainee but left in a few months to join the Doctoral Program in Management at the MIT (Massachusetts Institute of Technology) Sloan School of Management, and also received a Ph.D. for his thesis titled Essays on Banking in 1991 as well.

Since then he has gone on to work at numerous places at various positions and has managed to achieve a high name for himself.

It started with the Booth School of Business at the University of Chicago (Asst. Professor of Finance), then Stockholm School of Economics and Kellogg School in Northwestern University (Visiting Professor), and even taught an MBA course in international corporate finance and a Ph.D. course in the theory of financial decisions as well.

From October 2003 to December 2006, he even served as the Chief Economist at the International Monetary Fund (IMF) as well.

In 2007, a meeting between the then Prime Minister Manmohan Singh, Finance Minister P. Chidambaram, Deputy Chairman of the Planning Commission Montek Singh Ahluwalia, the PM’s Economic Advisory Council Chairman C. Rangarajan and bureaucrats from the finance ministry, had taken place.

This meeting concluded with requesting Raghuram to attend the next meeting. This was done because, since unlike the US, India did not include bright academics into public policy, there eventually would be a vacuum and the country would not have a strong economic mind in the making of public policy.

Anyway, once the next meeting with Raghuram was over, he was asked to prepare what is now called the Rajan Committee report on financial sector reforms titled “100 small steps”.

He was taken on board as the Honorary Economic Adviser to the then PM Dr. Manmohan Singh. He had even chaired the Committee on Financial Sector Reforms by the Indian Government (2007-2008).

His schedule was a very tight one – he would finish his class in Chicago, catch a flight to India, head straight to meetings, and after getting done catch the next flight to Chicago for the Monday class.

In 2012, he was promoted to the Chief Economic Adviser to the Indian Ministry of Finance, replacing Kaushik Basu, and prepared the Economic Survey for India for the year 2012–13.

After these stints, Raghuram Rajan took charge as the new Governor of the Reserve Bank of India in September 2013, for a term of 3 years, succeeding Duvvuri Subbarao.

And on 18 June 2016, Raghuram announced that he won’t be accepting the second term as RBI Governor and plans to return to academia at University of Chicago, after the end of his term in September.

How has he benefited the nation as the Governor of the RBI?

Before one can judge the performance of Raghuram, it is very important for you to understand, what really the job of the Governor of RBI is…!

Job of the Governor of the RBI

The Governor of the RBI is the bankers’ banker, and is also the banker to the government! He influences a wide range of Micro and Macro Economic issues of the country.

Some of the tasks of the Governor of the RBI includes regulating the various banks in the country and controlling the monetary policy of the country, at large, along with various other functions such as: -

- Printing of money (IF REQUIRED)

- Regulation of the financial system by managing the Repo Rate, Reverse Repo rate, Cash Reserve Ratio etc, monitoring different key indicators like GDP and Inflation,

- Controlling monetary policy of the country (how much money is flowing into the system) which includes: Inflation control, Control on bank credit, Interest rate control

- Control and supervise all the banks along with Issuance of Licenses to them, Risk Management, Audit and Inspection, Holding cash reserves of banks (Each bank deposits some portion of its cash to RBI), Development of banking system

- Foreign exchange control

How has Raghuram Rajan performed?

Raghuram was chosen for the role as the 23rd Governor of the RBI ahead of Arvind Mayaram (Secretary, Department of Economic Affairs) and Saumitra Chaudhuri (Member, Planning Commission).

He took charge by going on a leave of absence from the University of Chicago, Booth School of Business.

He took over the office at a time when the Indian economy was facing a big crisis. This was the period when the economy was going through a down fall, the Indian Rupee (INR) had taken a huge hit, the equity and bond markets were nervous, and the central government wanted quick fixes before the 2014 general elections.

His task was very clear! Bring the Inflation under control, and bring the Rupee down from the then current ₹70 to the dollar.

In his first speech as RBI governor, he started off by lowering the hopes of the masses and stressed that he has no “magic wand” to solve India’s multiple economic ills.

To fix an economy that had the world’s third-largest current account deficit of about $90 billion, high inflation and with a projected growth rate of 4% (nearly half of what it was in 2008); it will take time and some strict measures.

But at the same time, he also announced several measures to modernise and liberalise the Indian banking system even while clearing the cobwebs of the past, along with banking reforms and eased curbs on foreign banking.

Just after this speech, the BSE (Bombay Stock Exchange) SENSEX rose by 333 points or 1.83%, and after his first day at the office, the rupee rose 2.1% against the US dollar. And in the next two years, Foreign exchange reserves of India also grew by about 30% to around $380 Billion!

What sets him apart from the previous governors is that he is a man who firmly believes in the power of Communication! He believed that markets run on sentiments and sentiments do get a boost when there is a proper communication about the policy and direction of a central bank which was missing earlier.

This is followed by Bold decisions! When you are at a powerful position that can have a direct effect on the masses, it is very important that you should be well prepared to be able to take decisions, bold decisions. Even by putting your credibility at stake, if required!

And lastly, Not bending to pressures! Since the RBI is an independent unit but works in tandem with the government (particularly the Finance Ministry) it is bound to receive political pressures, but it is very important that your decisions are unbiased and unmotivated.

Below mentioned are some of the most notable achievements that Raghuram has brought about as the Governor: -

1. Unified Payments Interface and Payment Banks

UPI is an that has been launched to reduce the cost and time taken for making simple payments, and can be used to make transactions below ₹1 lakh.

UPI bypasses the long procedure of payment transfer, and all you need is the receiver’s unique ID, and a mobile pin to authenticate the payment, after which it is done!

Other than that, on the guidance of the “Mor committee” headed by his IIM classmate and banker Nachiket Mor (now a member of the RBI’s central board), RBI came up with the concept of “Payment Banks”, that would only accept deposits and not do any lending.

This initiative is aimed at providing banking facilities to nearly 2/3’s of the population who are still deprived of them. The RBI has licensed two universal banks and approved eleven payments banks to extend banking services.

2. Battle against Inflation

At the very beginning, Raghuram gave away with all the ‘many’ indicators that RBI used, to measure Inflation, and adopted CPI (Consumer Price Index) as their leading indicator, which is also the global norm, and gives better clarity on the demand side of the market.

And in this short-term itself, Raghuram has successfully managed to curb the retail inflation from 9.8% (September 2013) to 3.78% (July 2015), and Wholesale inflation from 6.1% (September 2013) to a historic low of -4.05% (July 2015).

3. Stable Currency (Rupee)

The full credit of stable currency (rupee) has to go to the RBI. When Raghuram took over the position, the currency was at around ₹70 against Dollar. We all know how rupee was going down the drains. But in a very short timeframe, he successfully managed to pull up the rupee.

Yes, many of you would point out that, the rupee is going down right now! But, it’s not that simple, there is a lot of complexity involved here! But to keep it short, the world markets are in a far worse condition right now. And believe me, when I say this, the rupee is very, very stable at this point, and is also protected from future volatility!

4. Monetary Policy

On his very first day in office, Rajan had talked about a new approach to formulating monetary policy, and in the same month, he had also picked Deputy Governor Urjit Patel to examine monetary policy framework, as well.

After its report, a rule-based policy was put in place, rather than a discretion-based one, and RBI also entered into a historic agreement with the government, with Inflation targeting as a stated objective. This Framework clearly stated the objective of keeping inflation below 6%.

5. Governance in Banks and Internal Restructuring

A committee under P J Nayak was set up to review governance issues in banks. As a start, the government has split the post of Chairman and Managing Director in public sector banks (PSBs) and have started hiring people from private banks, too.

Other than that, for better functioning, Raghuram had also initiated a total restructuring of the RBI from the inside, by organising RBI central office departments into five groups — Regulation and Banking Services, Supervision and Risk Management, Monetary Stability, Financial Markets and Infrastructure, and Operations & HR.

6. Tackling the problem of Non-Performing Assets (NPA)

These are accounts bad debts of the bank. Accounts that have not returned back the money. This is the problem, nobody wished to touch earlier. Indian banks hold more than $110 billion of corporate stressed debt, at this point. These are holding back fresh loans and hampering a speedier economic recovery. As you must have been seeing the news, Raghuram has already tightened the screws on banks and corporates `and has got into a deep surgery mode with the banks, to clean up their balance sheets and put stressed projects back on track.

Getting Inspired!!!

Thanks for sharing..